How To Get A Heloc With Bad Credit

What Is a HELOC?

A HELOC provides yous with a line of credit based on the value of your home, so you can borrow what you need when you need information technology, and repay the funds over time. In addition to a credit limit, HELOCs usually take a "draw catamenia," or a set amount of time when you lot tin can draw funds from your account.

Because your abode's equity acts every bit collateral, a HELOC is a secured loan. In other words, you risk losing your domicile if you default.

Pros

- Tin can authorize for one fifty-fifty with a fair or poor credit score

- Only infringe what you demand

- Many HELOCs don't have fees

- Flexible repayment options

- Interest on HELOCs can exist tax deductible if used to brand improvements to your abode

- Payments during the draw menses are frequently interest-only, which helps keep monthly payments downward

- Some lenders allow y'all lock in a rate during the draw period to avoid fluctuation

Cons

- Variable interest charge per unit at the mercy of the market

- Need considerable equity to qualify

- Need to pay any remaining debt from a HELOC if you sell your home

- Two mortgage payments instead of one

HELOC vs. Home Equity Loan

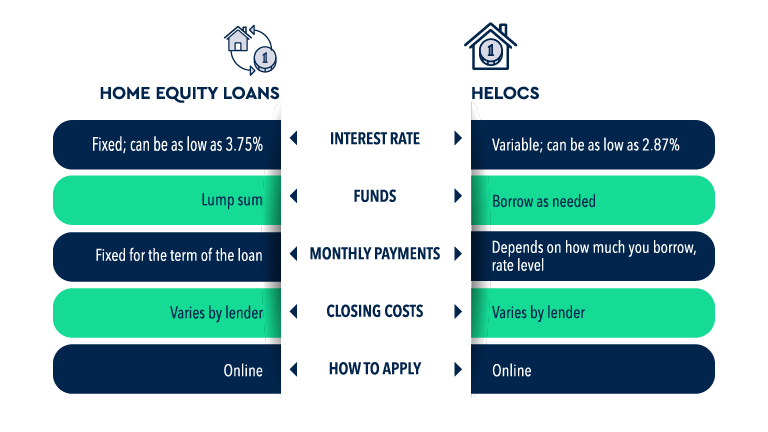

Dwelling equity loans are a type of second mortgage where you receive a lump sum of cash upfront. These loans have stock-still interest rates and stock-still monthly payments. Considering y'all're borrowing against the value of your holding, a home disinterestedness loan can be easier to get if yous have bad credit.

HELOCs, on the other manus, office more like credit cards. You can borrow up to a specific limit of your dwelling house equity and repay the debt over fourth dimension.

What Is a Bad Credit Score For a HELOC?

A bad credit score for a HELOC isn't necessarily the same equally a traditional bad credit score. Every bit with other loans, the college your credit score, the more than likely yous are to exist approved and receive amend terms.

The requirements vary by lender, but a FICO credit score of 620 is typically the lowest to get approved for a traditional first mortgage.1 A score this depression can make it tricky to go approved for a HELOC. You'll demand a lower debt-to-income ratio, you won't be able to borrow as much equity, and you'll take a higher involvement rate.

Having a FICO credit score of at least 700 mostly gives you a good take chances of qualifying for a HELOC at the maximum corporeality. But you lot still won't necessarily get the best rates. The best rates and terms possible typically get to those with credit scores of 760 or higher.

Things to Know About HELOCs With Bad Credit

If you lot're approved for a HELOC despite having bad credit, at that place are some factors y'all should go along in mind.

Higher interest rates

The worse your credit score is, the college your interest rate is likely to be because yous can exist considered a risky borrower. With a college interest charge per unit, yous're going to exist paying a lot more over time.

Changing terms

If your financial situation changes dramatically, your lender can change the terms of your loan. Depending on what'south been contractually agreed to, the lender can freeze or reduce your credit line. This could potentially exit you with less coin to borrow than y'all originally anticipated.

Risking domicile as collateral

With your habitation as collateral, missing payments can jeopardize your living situation. If you're unable to make payments for any reason, the lender can potentially prevent on your abode.

What Are The Alternatives to HELOCs?

Home disinterestedness loans are just ane culling to HELOCs, simply at that place are others.

Unsecured personal loans

Unsecured personal loans are based mostly on your creditworthiness. If you take a fair or poor credit score, it may be more difficult to get an unsecured loan. Though you'll have a higher interest rate and lower loan limit, you won't risk losing an asset with a missed payment.

Residual transfer credit cards

Another pick to consolidate debt is to look into a residual transfer credit card. This is unremarkably an selection if you desire to motion a credit card remainder from a high-interest carte to ane with a lower involvement charge per unit. Many credit menu issuers offer a 0% introductory annual percentage rate (April) for a ready period of fourth dimension. This method of debt consolidation tin help you pay off your debt more chop-chop.

Contact creditors

Explicate your state of affairs and why you're having difficulty making payments to your creditors if you need to. It'south possible to come to a payment agreement that'due south more manageable for you.

Source: https://www.credello.com/home-equity-line-of-credit/heloc-with-bad-credit/

Posted by: lambertanable.blogspot.com

0 Response to "How To Get A Heloc With Bad Credit"

Post a Comment